Annual statistics from Alconost, this time more intriguing than ever

This is Alconost's fourth year reporting statistics on the most popular languages for localization from English, but it's the first year we've used the phrase "for the first time" quite so often.

The 2023 list of top in-demand languages holds some surprises - both in terms of who's on top, and in terms of the invisible trends that produced such remarkable leaps.

To avoid losing sight of the forest for the trees, we'll ask five of our working experts, who have been managing Alconost localization projects for years, to comment on the numbers. They still know more about localization than any neural network out there.

Speaking of neural networks, we'll touch on AI trends from 2023 and have the experts comment on how they are changing the localization industry landscape. Grab a cup of tea. This is going to be interesting!

The formalities, in brief

-

This survey is based on in-house data from the localization department at Alconost Inc.

-

The report covers all the types of services (localization, proofreading, editing, localization quality assessment (LQA), machine translation post-editing (MTPE), and more) that Alconost's localization department performed in 2023.

-

Only orders with a starting language of English are considered.

-

Orders for languages with different regional varieties, such as Brazilian Portuguese and European Portuguese, are counted separately, not combined.

-

Customer orders through the online Nitro service, also owned by Alconost, are not covered in this report; they are addressed in a separate text.

-

Links to Alconost's language popularity rankings from previous years are here: 2022, 2021, 2020.

-

These rankings are not the ultimate truth, but rather a snapshot of the industry as seen from Alconost.

-

Only human intelligence was used to write this article and deliver it to you in English.

The Top 10 languages of 2023 — and all the firsts

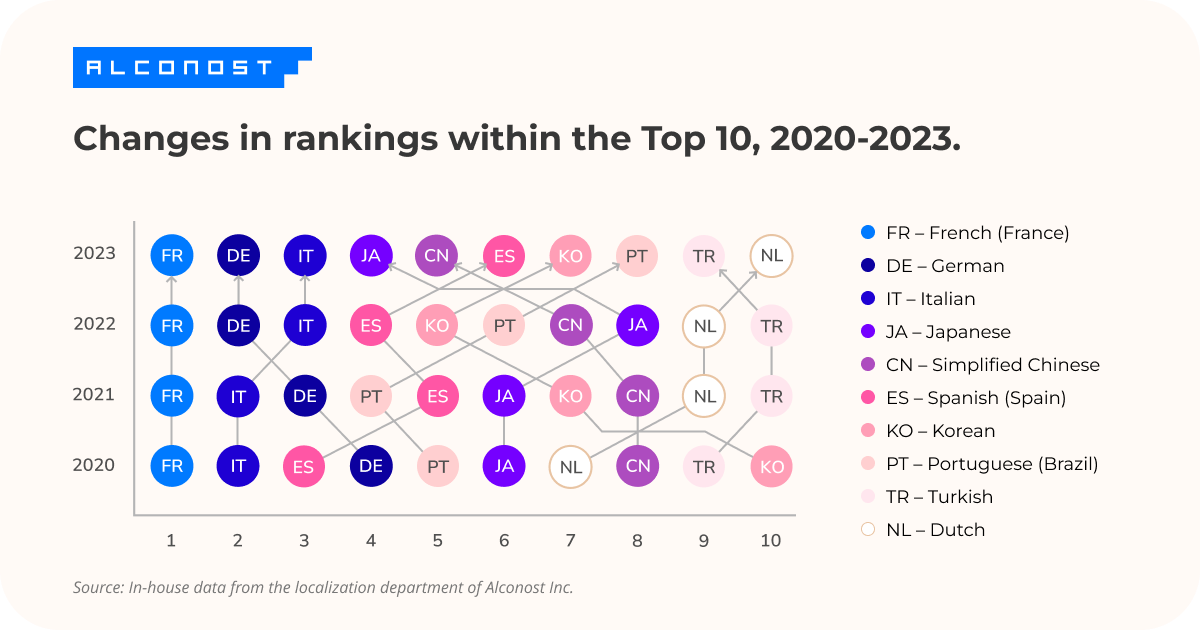

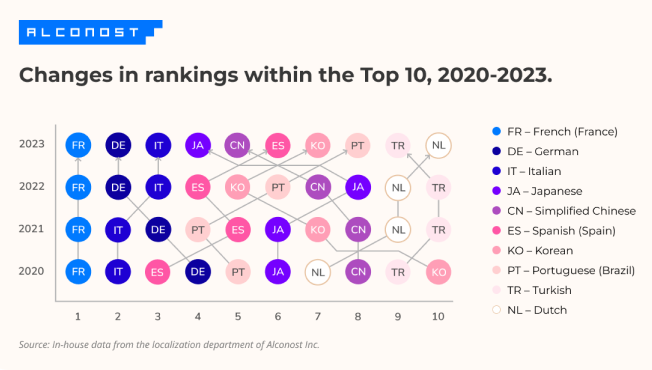

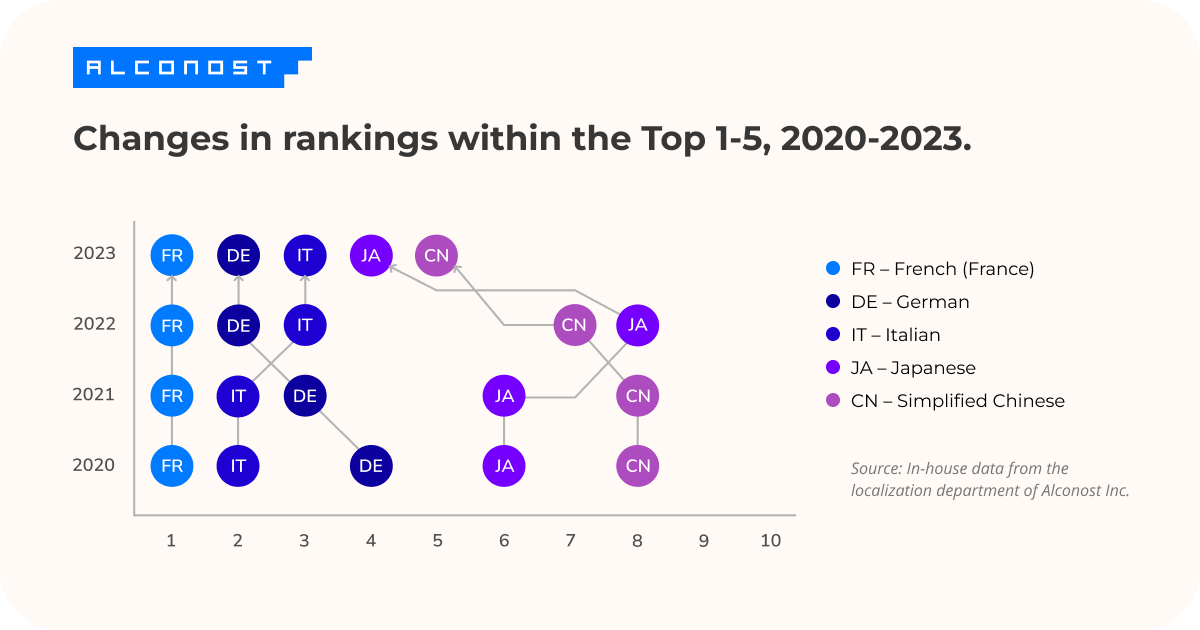

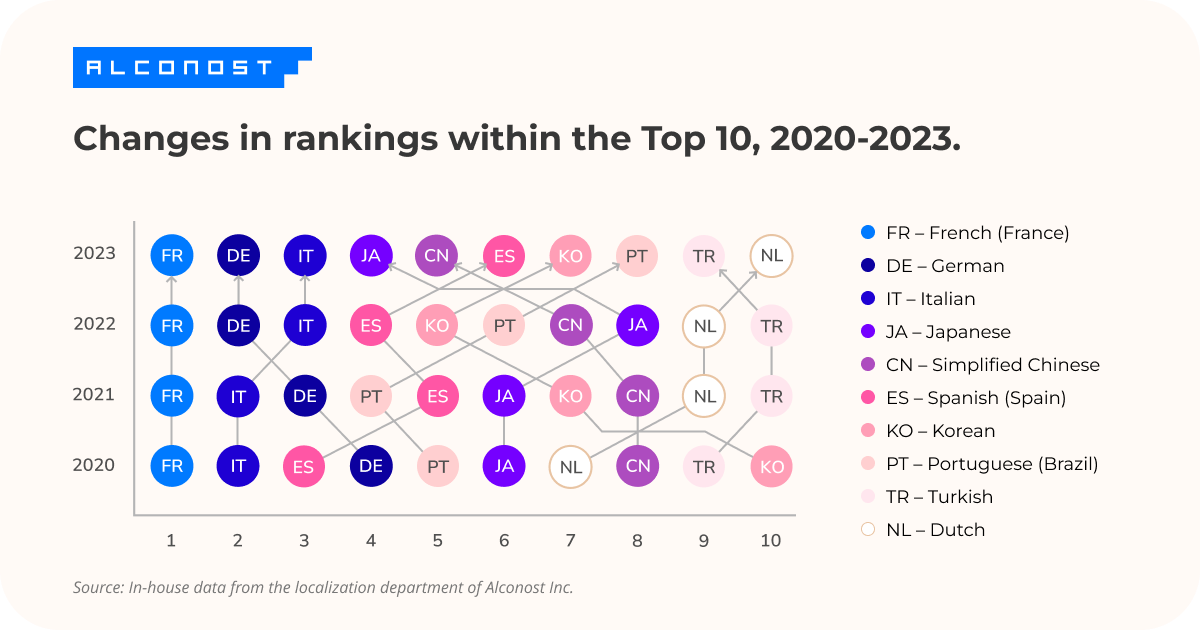

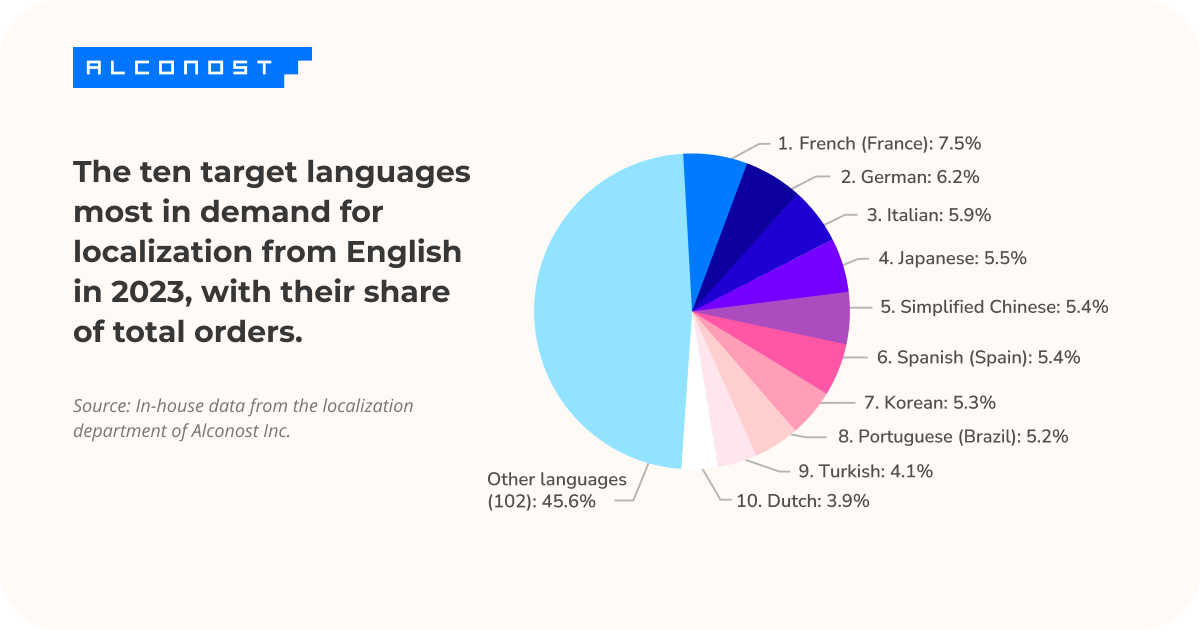

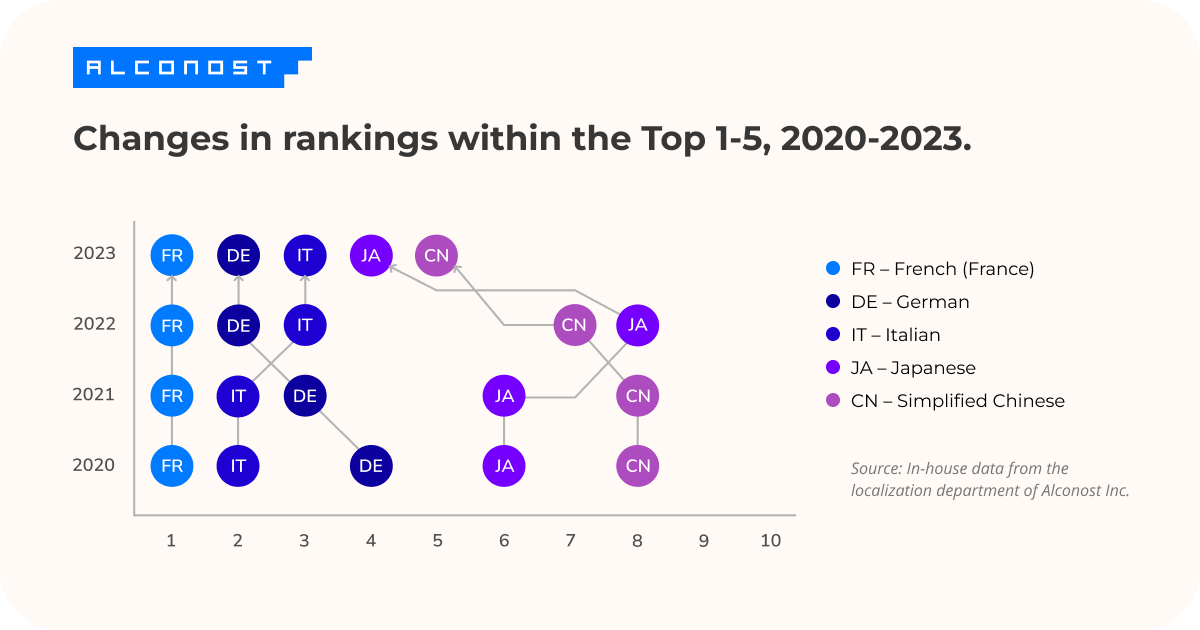

Alconost's most in-demand language for localization from English was French for France. French tops our rankings for the fourth year in a row, but this is the first time it made up such a small percentage of total orders: only 7.5%. Next was German, 1.3 percentage points behind. In previous years, the gulf in demand between first and second place has always been bigger. Italian came in third, closely behind German, but for the first time in four years, its share of the demand fell below 6%.

Japanese and Simplified Chinese came next in the list of leaders. This is the first time in four years that we've seen these languages in the Top 5 rather than the Top 10.

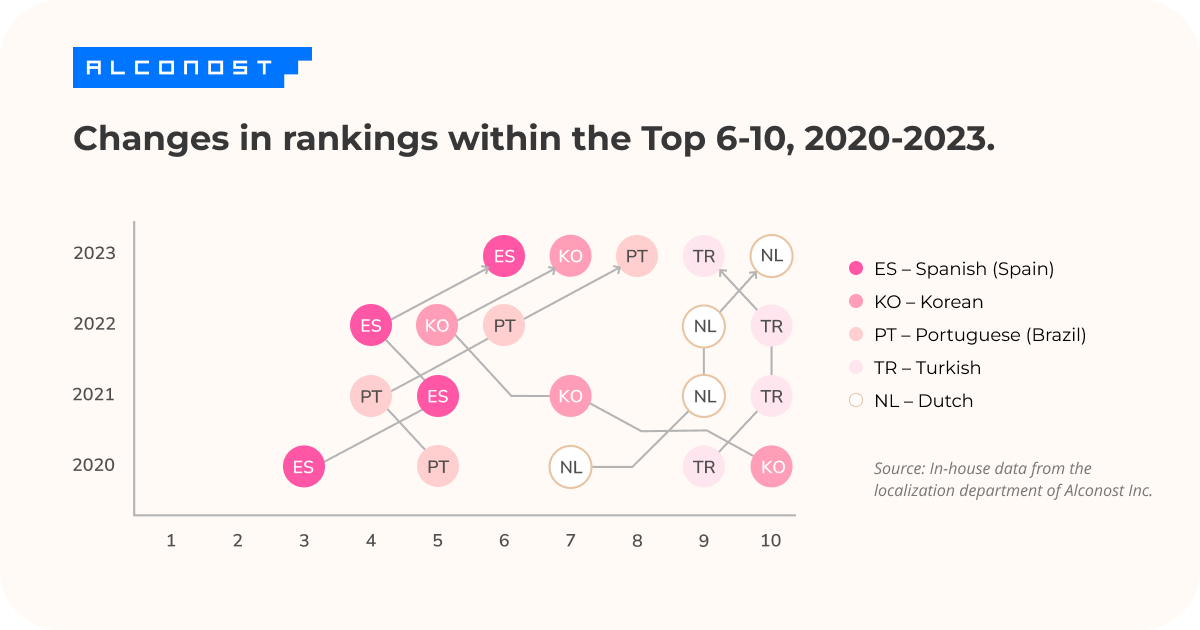

Spanish for Spain took sixth place. For the first time in four years, Spanish has fallen out of the top 5, but it was only one hundredth of a percentage point shy of that mark, and a tenth of a percent from making the Top 4. So it's too soon to declare that the four "classic" languages for localization— the FIGS languages (French, Italian, German, and Spanish) — have lost one of their own!

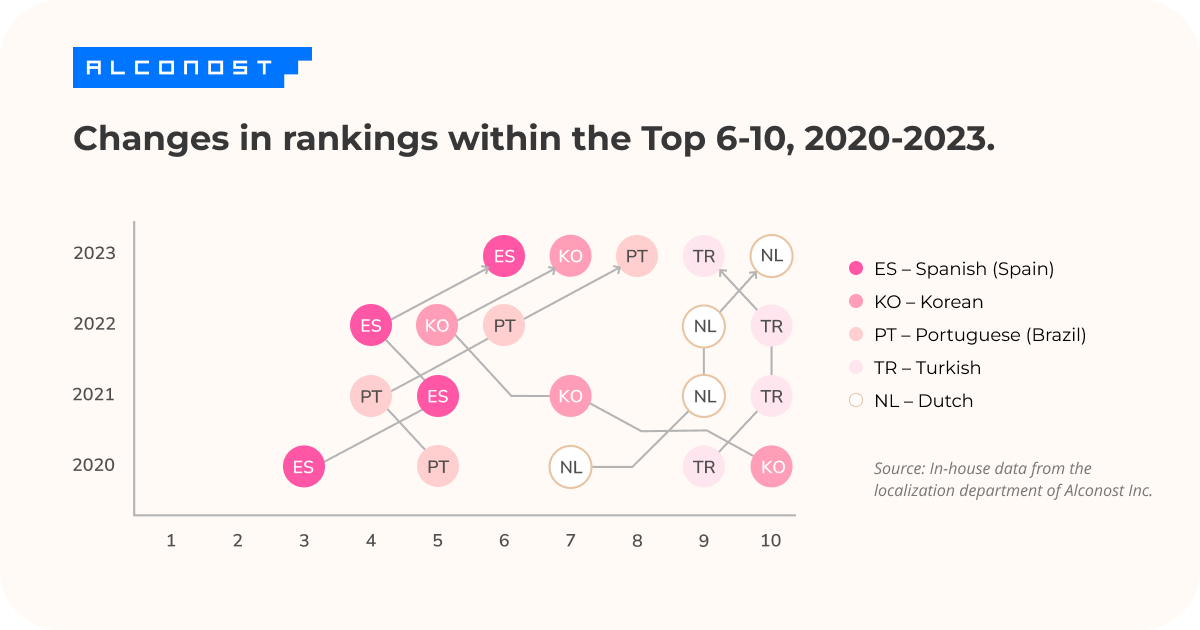

Korean and Brazilian Portuguese are next in line, taking 7th and 8th place, respectively, in 2023. Rounding out the top ten are Turkish and Dutch — same as last year, but in the opposite order. For the languages ranked 7th and 10th in 2023, those positions are their lowest ever.

A less mighty Top 10?

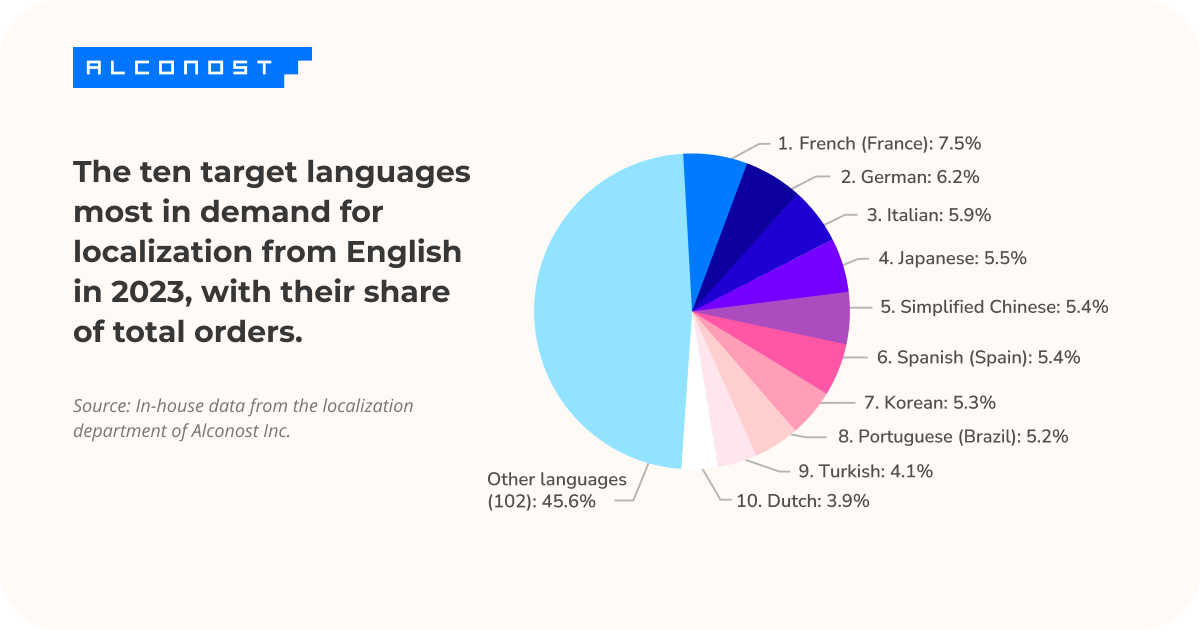

One surprise in the overall statistics for 2023 is that there is less distance than ever between the members of the Top 10. It's not just the very small gap between first and second place. This year's difference between 1st and 10th place is the lowest in four years, at 3.6 percentage points.

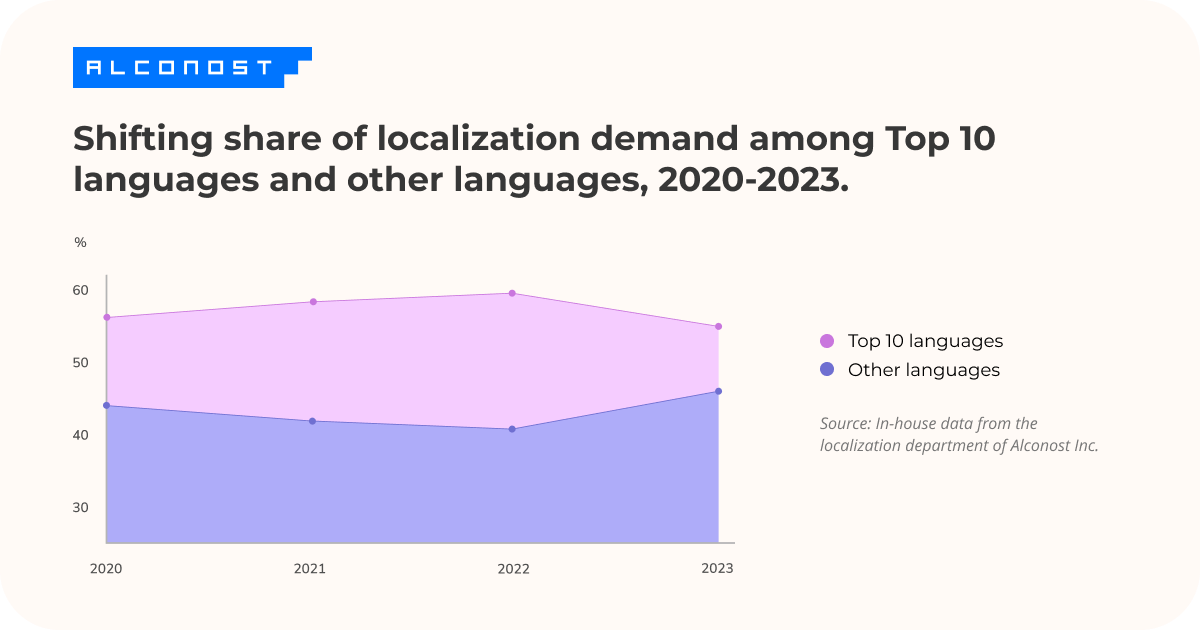

At the same time, we see that localization from English into languages outside the top 10 made up over 45% of the total, surpassing that percentage for the first time.

To us, this means that in 2023, Alconost's clients had growing demand for languages that used to be a second or even third priority for localization from English. Below, we'll discuss a possible reason for that trend. But first, let's look at the new members of the Top 5!

Japanese and Simplified Chinese: The experts explain

In our four years keeping track, this is the first time Japanese has been ranked so high, in fourth place. In 2020 and 2021, it ended up sixth, and then dropped to eighth place in 2022. Now, in 2023, it shoots up to the Top 4.

"Japan is a market that has money to spend, with an active consumer audience. I'm not surprised that localization into Japanese is attractive to foreign companies. Some want to enter that market, and others want to increase their presence there," says Irina Moiseichik, an Alconost localization manager.

"Japan is also known for its thriving game development industry. The Japanese are energetically developing their gaming market, so there's demand for that in the country. This means an increasing number of gaming companies are trying to break into the market by localizing their games for Japanese users," adds her colleague Diana Yaromskaya.

Simplified Chinese finished in fifth place this year, its highest rank in four years. Demand for localization into that language is clearly on the rise. It moved from eighth place in 2020 and 2021 to seventh in 2022, and finally broke into the Top 5 in 2023. For comparison, localization from English to Traditional Chinese finished 15th in our 2023 list, the same as in 2022.

"Often, when a client starts making plans to enter the Asian market and chooses a test language, they choose Simplified Chinese. It's the most widespread, and not as expensive as Japanese. From what I've seen, there are more of those test runs into Asia now, because many developers have already completed at least the first stage of their European localization projects," says Yana Tarasevich, another Alconost localization manager.

Now for the most interesting part. While both languages are in higher positions in our list than before, their jump wasn't due to claiming a greater share of orders. In 2022, Japanese took eighth place with 5.5%, but in 2023, that same percentage earned it fourth place.

The case of Simplified Chinese is even more intriguing. That language made it into seventh place, with 5.6%, in 2022, but in 2023, it only needed a 5.4% share to enter the Top 5.

So what's going on?

Which languages took over more of the demand?

Some of the demand formerly enjoyed by leaders in the Top 10 flowed straight to the languages sitting below 18th place in the 2023 rankings. That's the underwater part of the iceberg we can't see from the surface.

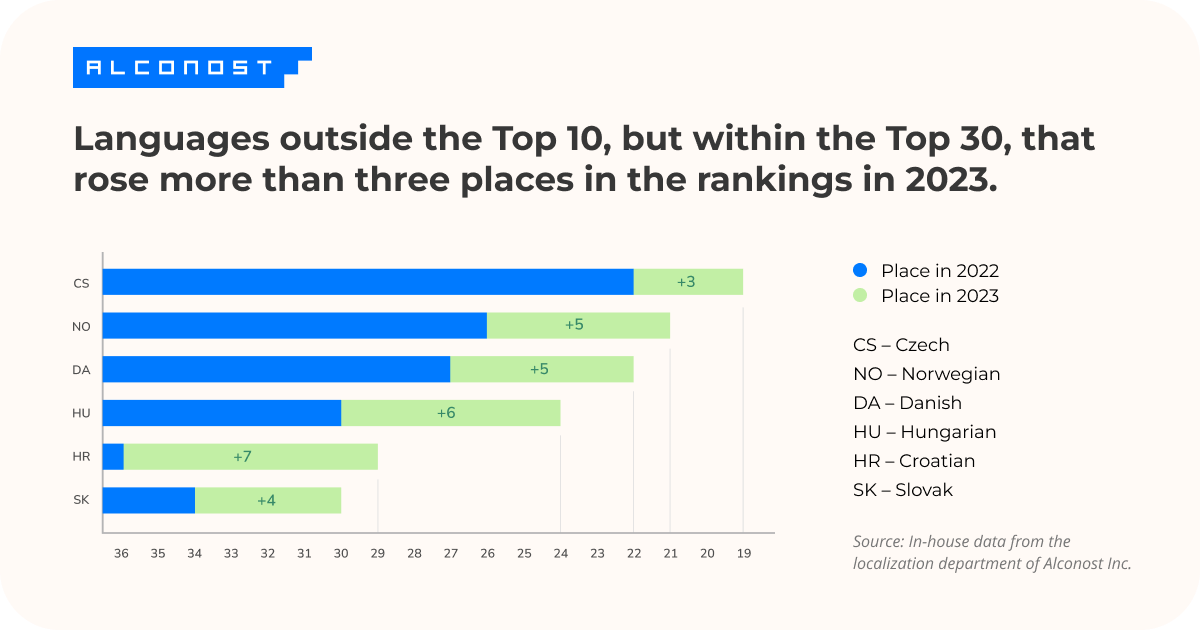

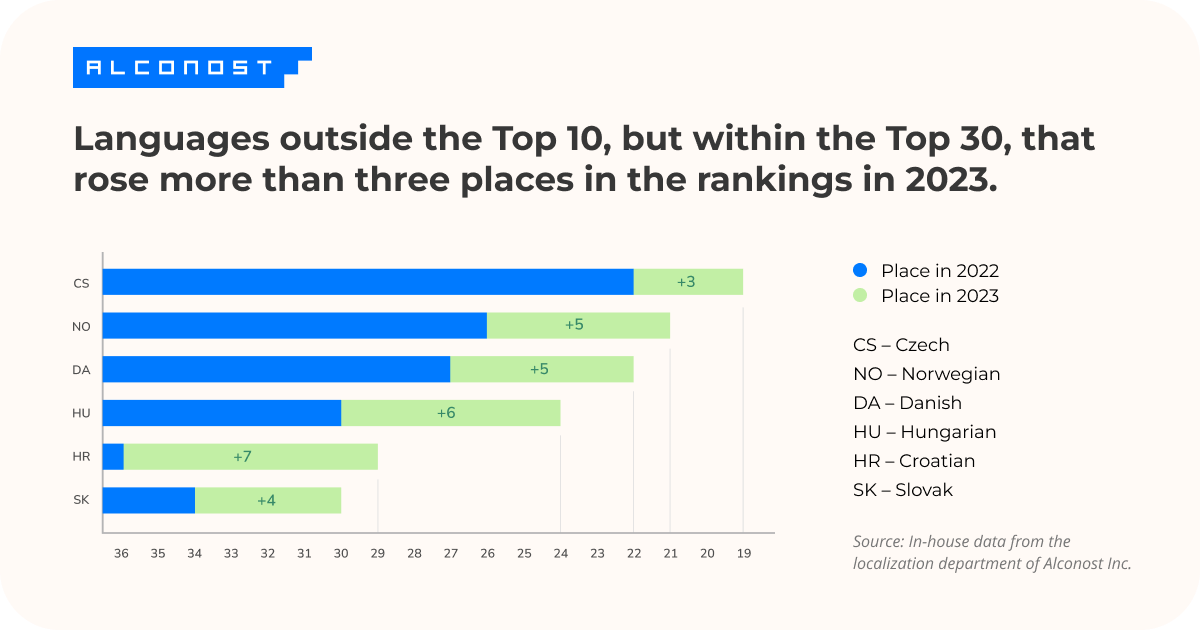

Analyzing the languages in 11th through 30th place, we noticed that six languages saw a noticeable growth in demand in 2023. Which ones?

-

Localization into Croatian grew from 0.43% to 0.9% this year, bringing it seven places up the list, from 36th to 29th.

-

Localization into Hungarian grew from 0.79% to 1.19% over the year, enough to propel it six places up, from 30th to 24th.

-

Norwegian and Danish, which occupied 26th and 27th place in 2022, with a share of 1.07% and 0.94% respectively, each climbed up five places. In 2023, these two languages represented 1.55% and 1.44%, respectively, of localization orders from English.

-

The share of demand for Czech and Slovak increased by 0.41% for each language. That put Czech in 19th place, with 1.62%, and Slovak in 30th with 0.89%.

These six languages alone saw their combined share of demand increase by 2.67 percentage points over the year, from 4.92% in 2022 to 7.59% in 2023.

Recall that French, the leading language, represented 7.5% of the demand in 2023. It turns out that six rapidly growing languages ranked below 18th place were more popular together, in terms of localization from English, than the language at the top of our list!

We will not look separately at languages whose share of total orders was under 0.8% in 2023. But we will note that the total share of orders into languages ranked below 30th place was 12.2% in 2023, up from only 9.5% the previous year. And the total number of languages in the group did not change significantly, with a difference of only two languages.

Why is demand growing for the less popular languages?

The leap in demand for Croatian might be explained by Croatia entering the Euro zone and Schengen area in 2023. But that fact doesn't explain the comparable growth in demand for the other five languages.

We think localization manager Yana Tarasevich has some helpful insight on the situation.

About the increase in demand for Norwegian and Danish, Yana says, "I think two factors are important here: the high purchasing power in those markets, and the fact that some of our long-term clients are transitioning to the second or third stage of their European localization programs, adding less popular languages to the main languages in their pool."

That may be the key to understanding what's driving the growing demand for languages outside the top group in this case. Clients whose products have been successful in highly competitive locations are moving on to the next steps of their localization plans. Logically, at the second stage, clients might want to add localization for countries with smaller populations but high purchasing ability. Then, at the third stage, they can secure their presence in the region by adding support for languages they didn't originally consider a priority.

In other words, Alconost's actively growing, long-term clients began transitioning to new stages of product development in 2023. These clients are continuing to expand, after beginning their journeys into foreign markets years ago, accompanied by Alconost. And Alconost sticks with them, regardless of which country or part of the globe is home to the market each client intends to conquer next.

One other point. On the falling popularity of Spanish localization, Irina Moiseichik notes, "I think we're seeing not so much a decline as a differentiation in demand. Look at the growth in LATAM Spanish, the unified version of the language which is considered appropriate for many different Latin American countries."

Sure enough, while demand is falling for Spanish for Spain and certain other varieties of Spanish, the share of localization orders requiring LATAM Spanish grew from 0.29% in 2022 to 0.48% in 2023.

How AI tools are altering the localization market landscape: Some subjective predictions on a hot topic

The use of AI tools for translation is expanding, and the localization industry has responded by offering professional services for revising machine translations (called MTPE, machine translation post-editing). Within that process, a native-speaker editor checks and improves upon the machine's output. We asked the experts to share their observations as to how this sector is developing.

Dima Winicki, Alconost localization manager: "I get the impression that demand for Romance languages is shifting from localization from scratch to MTPE. With the right preparation and setup, MTPE can provide decent results for Romance languages. We've seen that to be true in practice. But Asian languages are a slightly different story, and we may be waiting a little while. I just want to stress that results from AI tools vary when translating different types of content."

Yana Tarasevich: "One reason for the popularity of Asian languages in our rankings might be the fact that AI output for those languages is such poor quality that it can't even be edited. We need to translate those from scratch."

Hanna Zaneuskaya, Alconost localization department team leader: "When MTPE services were just starting up, we used to hear people saying that it would finally be easy to save money on translation. But any MTPE service actually requires significant preparatory work before the client starts receiving high-quality translations and saving money. I think that more clients began understanding those nuances in 2023, and now they see MTPE as just another tool for the work, not some kind of magic wand. I predict that using that tool in localization will have more of an impact on which services clients require from their agency, and less of an effect on the demand for any languages in particular."

Bonus fact

Take a look at the very bottom of our rankings, something most people never see. Falling below 105th place in the 2023 list is translation from English to languages such as: