Image created by SocialPeta

According to Top Countries by Smartphone Users 2020, published by Newzoo, the number of smartphone users has reached 953.55M in China and 83.03M in Japan, accounting for approximately 2/3 of the total population of each country.

The smartphone penetration rate is even slightly higher in Vietnam (68.2%). As for Indonesia and Thailand, roughly 6 out of every 10 people in these countries are smartphone users. Although it's a bit less than in China and Japan, it's still worth noting. In Bangladesh and India, the situation is different: for every 10 people in these countries, less than 4 are smartphone users. And in Pakistan, that number is only 2 in 10.

Source: Newzoo - Top Countries by Smartphone Users 2020

For game developers going east, here's our short overview of the local markets: what is popular here, how to maximize your product's chance at success, and what can go wrong.

Market Features and Preferred Game Types in Different Regional Markets in Asia

Mainland China: Oversupply and Fierce Competition

In the almost saturated mobile game market of mainland China, phenomenal products mostly come from local studios, which makes reaching this market difficult without innovation in both gameplay and marketing. Moreover, many games quickly fail to be released due to a stricter game publication system. To enter the Chinese market, it seems that one of the options is to cooperate with a local partner. Previous successful games such as Angry Birds and Subway Surfers all have local partners in China.

Hong Kong, Macao, and Taiwan: A Loose Policy

source: SocialPeta

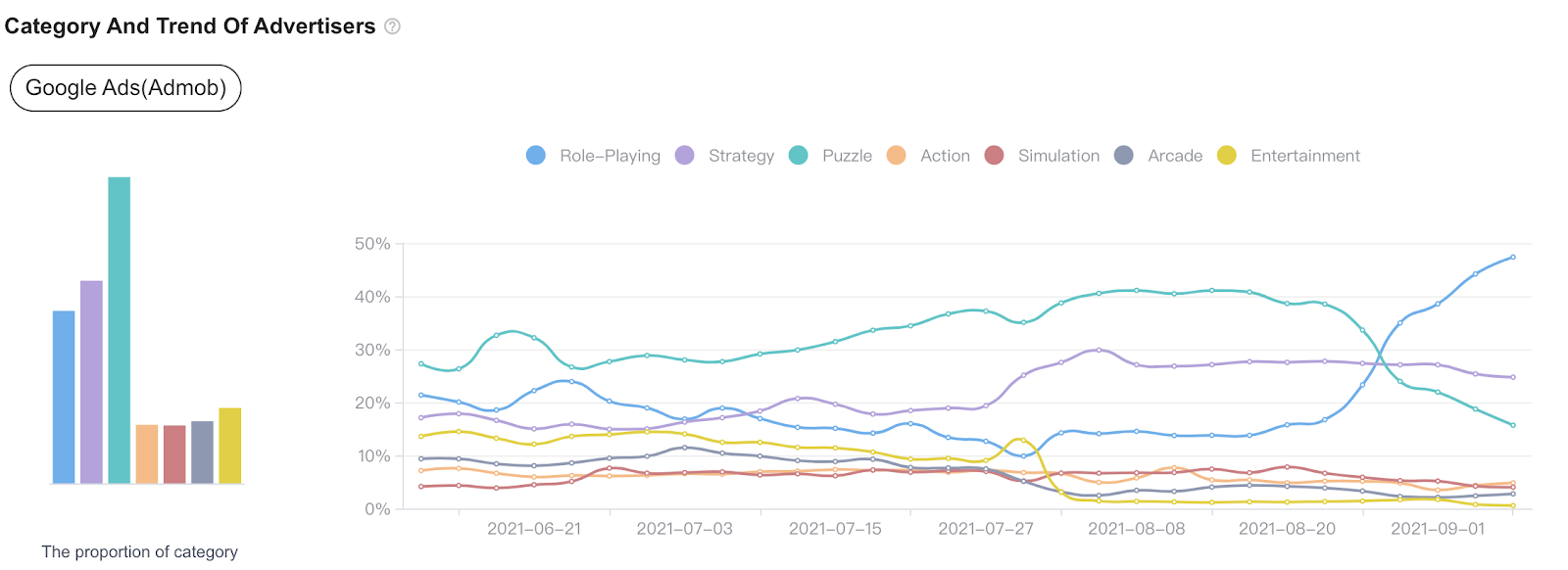

The regulatory policy on mobile games is relatively loose in Hong Kong, Macao and Taiwan, and overall wifi deployment is rather friendly to downloading games. Various types of games can be accepted by players in these regions. According to media buying data captured by SocialPeta from Google Ads within the last 6 months, the top categories of advertisers are role-playing, puzzle, and strategy games.

Of course, advertiser activity and the actual demand on the market are not absolutely equal things. However, the campaigns of these advertisers were performing well and led to good download results. This, we assume, indicates that there's a large proportion of players in this market who might be interested in games in these genres.

Japan: The Highest Demand for Localization

source: SocialPeta

Japan has a high cultural barrier and preferred mobile game types are relatively fixed. Data from SmartNews shows that strategy games make up the largest proportion in the last 3 months; through FB News Feed, puzzle and simulation advertisers show better performance.

South Korea: The Highest Penetration of Mobile Games

source: SocialPeta

With only 39.2M smartphone users, South Korea didn't enter the top, but did have a 76.5% smartphone penetration rate back in 2020, and people enjoy playing games here. From SocialPeta's media buying data of mobile games on Google Ads, we can see that categories of active advertisers show little change within the last 3 months, and puzzle games are the most popular in South Korea.

Southeast Asia: A Younger Market

source: SocialPeta

In Southeast Asia, major paying users are ages 39 and below, and puzzle games are the most popular category. Southeast Asian users show greater social interest than those in other regions. Male users tend to play competitive games because of interest in esports competitions, while female users prefer casual games.

Difficulties and Solutions for Localization in Asia

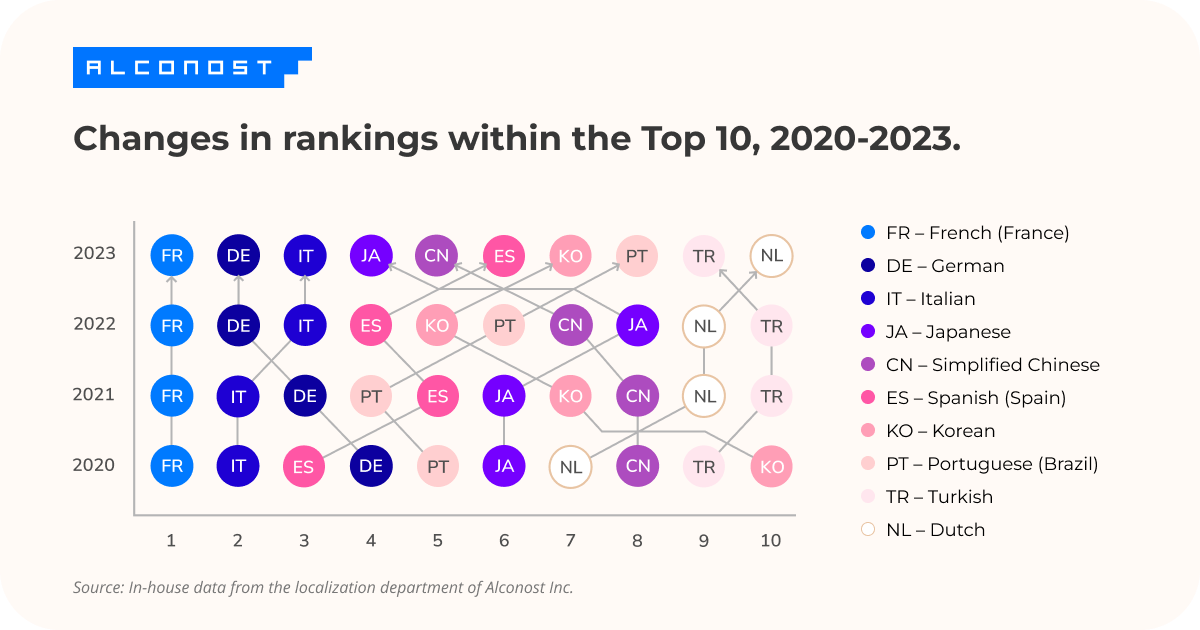

1. Language Translation

It's not enough to have just an English localization when going to Asia; the game should be available in the local language as well. Otherwise, it's not likely to win over many local players. Translators need to have a deep understanding of both the source and target languages to transmit the initial ideas of the developers in a way that will be understood and accepted by local players. And, last but not least, it's crucial to find translators who have a gaming background and experience translating games, as even an experienced translator might have difficulty with terminology if they've never translated games.

Halamish, a senior executive at the digital distribution company Ironsource, once said in a meeting, “If you want to make western mobile games succeed in China, you need to cooperate with local people. This is difficult, but it is the only way to success.” Therefore, we suggest that feedback from native game players, sociologists, and people with special experience in game localization should be taken into account.

2. Cultural Taboos and Interests

“Not only text is localized”, Johnny Lo, a senior financial executive of the Japanese internet advertising company Septini, once mentioned as the most noteworthy problem in localization, “but culture should also be localized. Images and the whole game system need to be adjusted.” You need to be just like natives.

Traditional culture is very popular in China, but elements related to national flags should be avoided. Japanese players typically play games during their commute, and tend to choose a game based on trends in large markets. Users in South Korea prefer gorgeous scene design, and characters need to have local features. Countries in Southeast Asia are often discussed together, but customs are quite different from country to country, and special attention should be paid to religious taboos.

3. Marketing Strategies

PUBG MOBILE and BlackPink Joint Mobile Game Live Streaming

In addition to normal advertising, different marketing strategies should be adopted for different regions. With a rather high demand for privacy, Japanese players prefer taking part in large offline events to attending UGC activities. In Southeast Asia, where players are younger, esports competitions can create greater participation among players. In South Korea, promotion can be carried out with the influence of K-pop idols. The app market is complex in China, where strong social networks such as TikTok and Weibo are recommended for dissemination.

To sum up, localization in the Asian market requires you to have a sufficient understanding of the local culture, to always pay attention to market feedback on preserving the high quality of games, and to outperform local manufacturers in localization while retaining the uniqueness of your products.

Bonus!

Our partner SocialPeta offers a full-featured 3-day trial account. Click the link to immediately get access and monitor your competitors’ UA strategies.

SocialPeta is an analysis platform for ad creatives and marketing strategies for both advertisers and publishers. SocialPeta covers advertising data from 80+ global ad networks across 70 countries and regions.